In video games, “easy mode” is a popular setting that makes the gaming experience more accessible and less challenging for players. When you play in this mode, the game automatically adjusts various elements to make your journey smoother and more manageable. Enemies become weaker, resources are more abundant, and the consequences of making mistakes are less severe. This allows players to enjoy the game at a pace that suits their skill level without feeling overwhelmed or frustrated.

Like gaming, many people find the world of finance and investing intimidating and complex.

Here we explore how applying “easy mode” strategies to financial planning can help you manage your finances more effectively and achieve your goals.

The challenges of financial planning on ‘Default Mode’

Financial planning can be daunting and complex. It’s understandable that many investors are overwhelmed by the sheer amount of financial information, investment options, and ever-changing market conditions. This complexity often leads to pitfalls and obstacles, such as short-term thinking, emotional decision-making, and a lack of a clear, long-term financial plan.

Operating in this mode can take a significant emotional toll. We meet prospective clients for whom the constant stress and anxiety of making the right financial choices has left them feeling paralysed and unsure of how to proceed. The lack of a clear plan will also increase the risk of financial setbacks and losses, further compounding the emotional stress of investing.

Recognising these limitations is the first step towards finding a better way to manage your finances. We firmly believe that the best way to increase the probability of success is to embrace simplicity, not complexity… and we’ve seen the benefits first-hand.

Ironically, it is often our wealthiest investors who struggle most with ‘simplicity over complexity’, especially when they have previously been ‘baffled with complexity’ for years by wealth managers or private banks.

Switching to ‘Easy Mode’

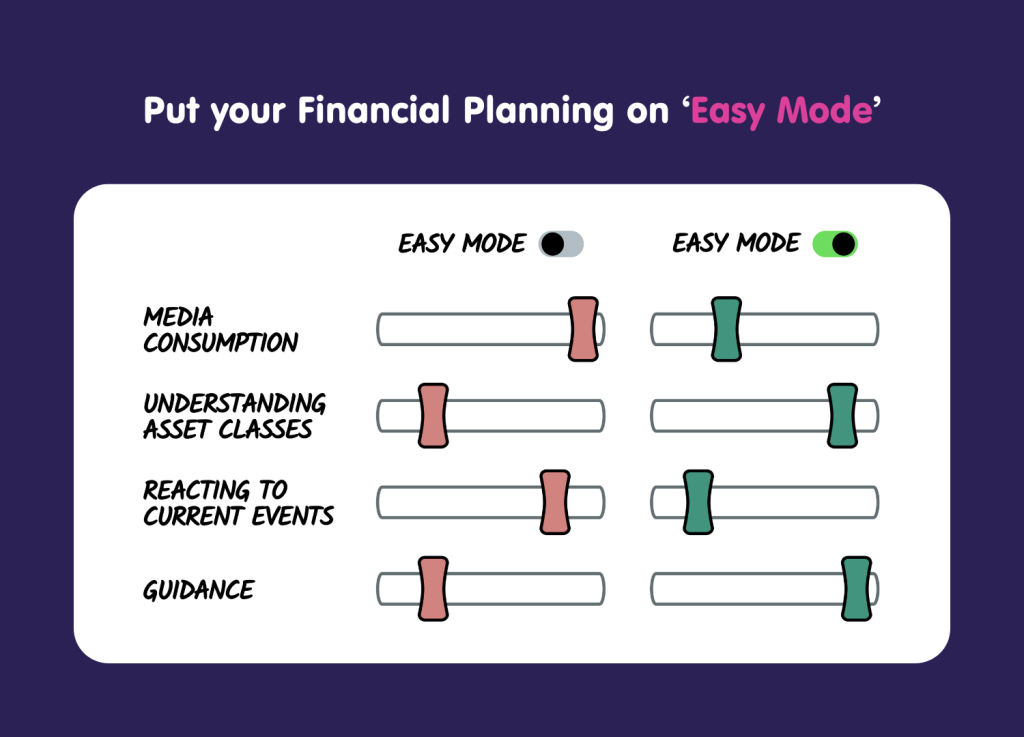

Transitioning from financial planning’s default mode to “easy mode” brings a sense of relief and empowerment. Like in gaming, “easy mode” in financial planning makes enemies weaker, resources more abundant, and the consequences of mistakes less severe.

One of our biggest enemies in the financial planning journey is the constant media noise surrounding us. Regularly consuming news about short-term market movements and recent world events does not set us up for making smart long-term decisions. Smart investors know that success is more likely if they remain focused on the long term, which is easier when they are mindful of the information they consume.

Financial planning is the quest to accumulate enough resources for a dignified and independent retirement. Long-standing clients of boosst will have seen markets rise and fall many times, giving them first hand experience of how the asset classes we hold offer them the best chance of growing their resources and fighting inflation. They also know that by diversifying within the right asset classes, we can put the odds of success in their favour.

The final way to stay in ‘easy mode’ is to avoid making emotional decisions that will undo the effects of your previous good decisions. We often meet prospective clients who recall stories of times they were struck by panic, and withdrew investments at a low, or worse, didn’t proceed with planned investments because markets fell. If only they had our guiding hand to support them through the difficult times. Smart investors understand market history and investment cycles, allowing them to stay focused on the long term when others react emotionally. This is another hallmark of those playing on “easy mode”.

Help is on the way!

Embracing “easy mode” means focusing on long-term, goal-oriented strategies that align with your values. It involves prioritising the essential concepts and actions for your success.

Collaborating with one of our financial planners gives you a significant advantage on your journey, but never forget that the principles of simplicity, clarity, and emotional resilience remain invaluable.

We encourage you to remember that the power to transform your financial life lies within your hands. Embrace the simplicity and clarity of the “easy mode” approach and take confident strides towards a brighter financial future.

Not yet a boosst client?

We exist to guide families on this path, and we invite you to contact us if you need help putting your financial planning in “easy mode.”